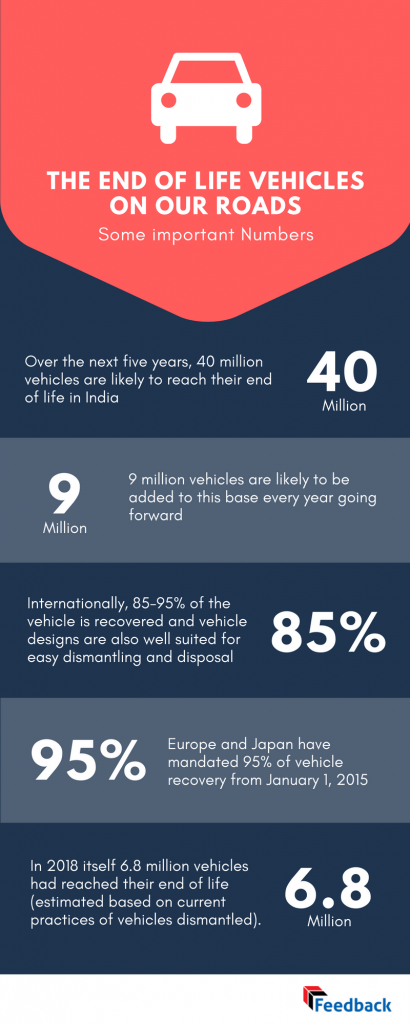

Over the next five years, 40 million vehicles are likely to reach their end of life in India. 9 million vehicles are likely to be added to this base every year going forward.The new policy proposed, aims at encouraging people to scrap their old vehicles and replace them with modern, more fuel-efficient and less-polluting ones, by offering tax and other benefits. The big question before us is how are these vehicles going to be handled? Do we have the infrastructure to handle the dismantling of these vehicles?

Over the next five years, 40 million vehicles are likely to reach their end of life in India. 9 million vehicles are likely to be added to this base every year going forward.The new policy proposed, aims at encouraging people to scrap their old vehicles and replace them with modern, more fuel-efficient and less-polluting ones, by offering tax and other benefits. The big question before us is how are these vehicles going to be handled? Do we have the infrastructure to handle the dismantling of these vehicles?

Internationally, 85-95% of the vehicle is recovered and vehicle designs are also well suited for easy dismantling and disposal. Europe and Japan have mandated 95% of vehicle recovery from January 1st, 2015. A similar policy has been proposed by India and there is interest by various companies to set up automobile recycling facilities.

ELVs are dismantled in scrap yards in the city

Automobile recycling is used extensively to help reduce waste, aid in the reuse of components and recycling of raw materials. End-of-Life Vehicles (ELVs) contain many materials and parts that can be refurbished and reused. A wide range of materials, from valuable metals to low grade used oils can be retrieved from end-of-life vehicles.

Currently in India, the management and disposal of ELVs are essentially in the domain of the informal and unregulated sector, unlike several other countries that are in a fairly advanced stage of automobile recycling. Interactions with the formal sector are non-existent. ELVS are dismantled using hand tools and equipments.

In 2018 itself 6.8 million vehicles had reached their end of life (estimated based on current practices of vehicles dismantled). Rest continue to be used or are often sold to buyers from smaller towns and cities.

Cars: 0.73 million Nos; Two wheelers: 5.37 million Nos; commercial vehicles: 0.42 million Nos

Cars: 0.73 million Nos; Two wheelers: 5.37 million Nos; commercial vehicles: 0.42 million Nos

ELV dismantling is undertaken in small scrap yards located within the city limits of all major cities. Historically, these scrap yards mushroomed in the outskirts of large cities. However, as the city limits expanded over time, the scrap yards have remained in the same locations and integrated into the city’s densely populated areas. Consequently, they are constrained by lack of space with limited or no scope to expand their operations.

Some of the major scrap yards in India are in the densely populated cities – Mayapuri in Delhi; Shivajinagar, in Bangalore; Afzalgunj in Hyderabad, Transport Nagar, Mechanic Nagar & Bhamori in Indore, Kurla in Mumbai;Boarder Thottam, Pudupet in Chennai.

Mayapuri, in West Delhi is India’s largest recycling hub, which as per our estimates and industry sources, accounts for nearly 20% of the vehicles dismantled across the country. It is estimated that nearly 200,000 vehicles are dismantled in Mayapuri every year. Similarly, Stephen’s Square, popularly known as Shivajinagar gujri in Bangalore, is one of the oldest scrap yards in the country. In each of these scrap yards there are over 500 shops which retail auto spare parts recovered from the dismantled vehicles.

Mayapuri, in West Delhi is India’s largest recycling hub, which as per our estimates and industry sources, accounts for nearly 20% of the vehicles dismantled across the country. It is estimated that nearly 200,000 vehicles are dismantled in Mayapuri every year. Similarly, Stephen’s Square, popularly known as Shivajinagar gujri in Bangalore, is one of the oldest scrap yards in the country. In each of these scrap yards there are over 500 shops which retail auto spare parts recovered from the dismantled vehicles.

ELVs as well as accident vehicles are brought to the yard by dealers, brokers or agents. Individual owners rarely involve themselves directly in the sale of their vehicles; they generally operate through brokers or agents.In the case of accident vehicles, police auction the vehicles to brokers / agents in lots of 40-50. Similarly, government / institutional customers auction the vehicles they wish to scrap. Government run transport organisations operate their own scrap yards where usable parts are recovered before auctioning the vehicle for disposal.

Over a 100,00 people are employed across these scrap yards directly as well as indirectly. The ecosystem comprises brokers, agents, dismantlers, helpers, retail shop owners, sales people and all other services addressing this community.

It is important that all stake holders look at how the End of Life vehicles are disposed. This is an industry whose time has come, and perhaps a Government policy on re cycling would help

What is the trajectory of the scrap that is being generated based on disposal of vehicles who have reached the End of Life Vehicle?

There is a huge potential to bring all the scrap generated by End of Life vehicle disposal into the main stream.

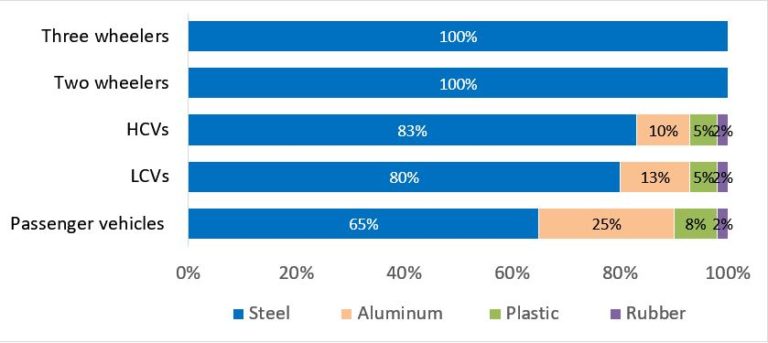

In 2018, 6.8 million vehicles reached their end of useful life. However, a small % appear to have been dismantled in these scrap yards. Scrap yards in the country handled 733,000 tons of scrap from dismantling 0.68 million ELVs in 2018. This comprised primarily of steel and aluminium and a small percentage of plastics and rubber.

Nearly 50-60% of the spares are recovered in passenger vehicles and over 75% in two wheelers. All these parts are routed to automobile dealers/ spare parts dealers with a presence in the general vicinity. Some of these spares get sold immediately to mechanics and end users, while some languish in the spare parts outlet for years. Recovery is generally higher in accident vehicles, however dispute resolution which is time consuming, often results in deterioration of parts. In commercial vehicles, recovery of spares is estimated to be in the range of 50-60%.

Typical tonnage across vehicle categories:

Among the various vehicle categories, commercial vehicles are the largest contributors to scrap. Spare parts retrieved from the dismantled vehicles are routed to spare parts dealers located in the same locality. While the dealers stock all parts, not all of them find ready markets. Some of the spares gather dust on the dealer’s shelves for months before they get sold.

The total revenue generated from the sale of spares & scrap of ELVs in 2018 is estimated at Rs. 2,400 crores. Downstream revenue generation through resale of scrap, recycled plastics and lubricants has not been reckoned.

Need to fast track development of infrastructure

A policy for recycling is welcome. It also throws its own set of opportunities and challenges for the industry and government alike. There is need to establish infrastructure, build capacities to handle the large volume of vehicles that are likely to come in for recycling. Investment infrastructure alone will not be sufficient, introduction of relevant technologies to increase throughput with requisite training of labour will also be required.

Incentives need to be provided to various stakeholders in the value chain to move the entire dismantling to the organized sector – to the owner for selling his old vehicle, to capacity builders as well as to brokers and agents to handle more volumes and adopt organized market practices. Attention needs to be paid to skilling employees that will be displaced in these scrap yards.

With attention on environment and changing technologies, it is critical that government, the automobile manufacturers along with the downstream disposal entities work on a formal framework on vehicle disposal so that there is optimal re use and recycling.